REITs In Canada

How do REITs work?

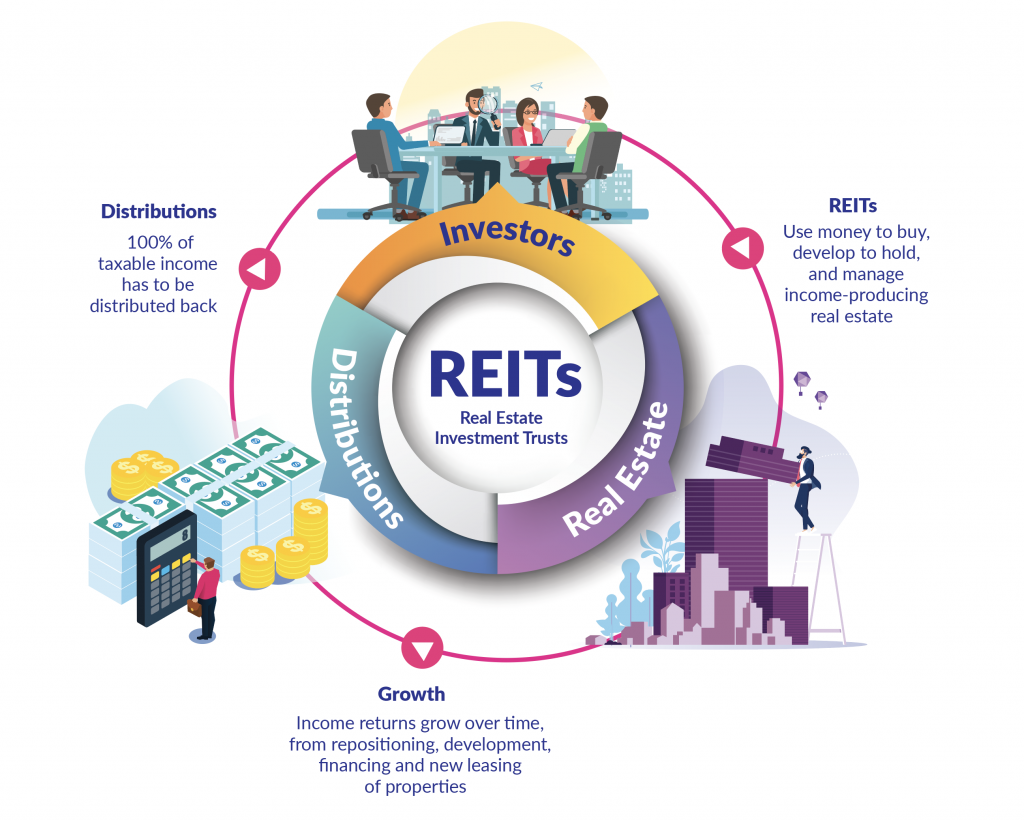

REITs exist to provide unitholders with stable and growing cash distributions, typically payable monthly, from investments in a diversified portfolio of income producing real properties. They allow small investors to participate in the ownership of larger income producing real estate assets, such as office buildings, apartment buildings, shopping centres, and industrial properties on the same basis as wealthy investors can do directly. REITs exist in 42 countries around the world in 2020, and represent for many retail investors a safe source of supplemental or retirement income.

Modelled after mutual funds, Canadian public Real Estate Investment Trusts (REITs) aggregate capital to build, acquire, operate and update the offices, apartments, retail properties and industrial facilities that a growing Canadian economy needs. REITs are now enabled in 42 countries around the world, and continue to grow in market size and reach.

- REITs provides individual investors with the opportunity to participate in different sectors of the real estate market.

- Income earned by a REIT is passed on to its unit holders, giving investors similar investment income to that of direct property owners.

- Just like a mutual fund, REIT investors benefit from enhanced buying power, diversification, liquidity and professional management.

Why are REITs important in the Canadian economy?

For most people, real estate investing is limited to home ownership, with little thought of ever owning an office tower, a shopping mall, or an industrial warehouse. With REITs however, individuals can participate in the ownership of commercial properties and reap the benefits of stability, growth and diversification that institutional investors have enjoyed for decades.

Canadians use REIT investments to support their retirements

Many Canadians depend on REIT income to fund their retirement and in many cases invest in other retirement funds which own REIT units, such as mutual funds and ETFs. In this way, they have many of the same characteristics as retirement pension funds.

REITs are good for the Canadian economy

REITs encourage capital formation and allow small investors to participate in the ownership of all real estate asset types on the same basis as the wealthy do, but with the added benefit of liquidity. Capital stays in Canada for the benefit of Canadians.

REITs in Canada are an approximately $80 Billion market cap industry[1]

From their creation in 1993, Canadian REITs have grown and provided millions of Canadians with stable income from a pool of real estate investments. Canadian publicly traded REITs to have a track record of positive distributions, and a current average 4.7% distribution yield [2].

REIT Asset Portfolios

Canadian REITs invest in all the major asset classes, including office, retail, industrial and multi-family developments.

REIT Governance

- REITs have strong governance controls: Real estate investment trusts in Canada are governed by a Declaration of Trust, which requires the entity to acquire or develop and own income-producing real property for the long term. REITs are also required to provide investors with regular distributions, giving them access to investment grade real estate, diversification, regular income including retirement income, professional management, new development management, and long-term capital appreciation. Many REITs are also leaders in Sustainability initiatives within the public and private markets.

- REITs are subject to strict regulatory oversight: REITs are subject to oversight by Canadian securities regulators and therefore bring a high level of governance and transparency to the industry. In over 25 years since they were first enabled, there has never been a failure of a Canadian REIT.

- REITs are tax neutral: Canadian publicly traded REITs must pay all of their taxable income out to investors, who are taxed on the income and capital gain portions of those distributions. Through tax integration mechanisms, individual investors pay tax on the taxable portions of their REIT income distributed to them annually at their marginal tax rate, which is theoretically intended to be roughly equal to a corporation paying tax, then paying dividends to a shareholder who then gets the dividend tax credit. Consequently, REITs are tax neutral to governments.

- REIT properties are professionally managed. This means that REITs often target high industry and real estate standards, provide a high level of maintenance, provide regular capital improvements to buildings, and have dedicated staff focused on building quality and tenant satisfaction.

Contact

Michael Brooks, CEO, 416.642.2700 x225.

References

[1] As at March 1st, 2021. Source RBC Capital Markets DMI

[2] As at March 1st, 2021. Source RBC Capital Markets DMI